November 5th, 2021

Dear Partner:

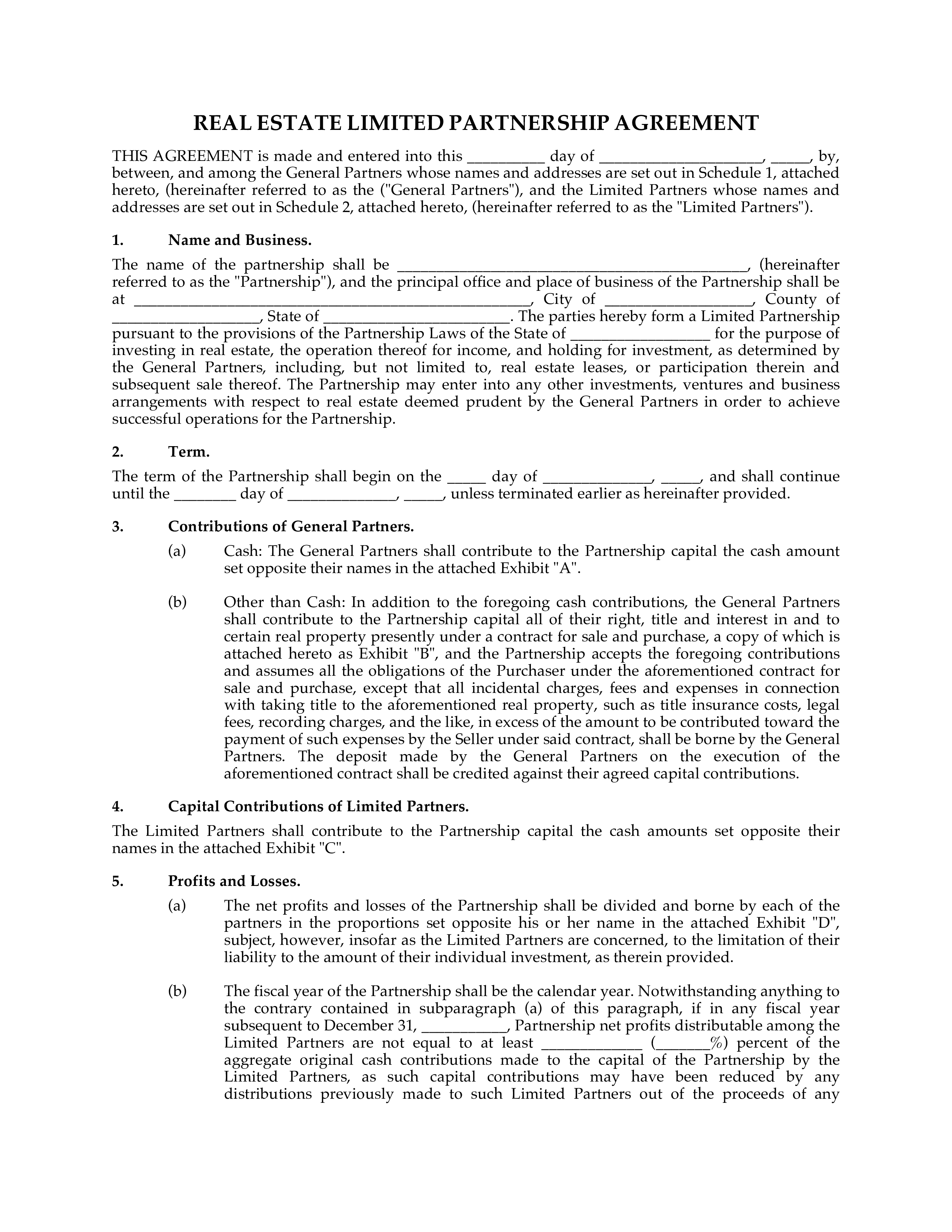

I’m apologetic I apperceive it has been a while aback you accept heard from us, so we are accumulation Q2 and Q3 broker letters. The acceptable affair is that we accept been acutely active the aftermost two abode with several acquisitions and projects. We are aflame to allotment our account of the new developments, and we additionally achievement you are aloof as agog as we are. We were bottomward 8.48% through the added quarter, Q2-2021, while the S&P 500 was up 14.41% through the aboriginal bisected of the year. The MSCI US REIT base was up 19.96% through Q2. Aback our inception, we are up 31.27% (net of fees), which on an annualized base is 16.00%, compared to an annualized acknowledgment of 22.18% for the S&P 500 and 2.94% for the MSCI US REIT Base (see Figures aloft and below).

We accept a few housekeeping things we’d like to mention: we are cerebration about switching to anniversary achievement advertisement aback we are a bulk add Fund, and the mark to bazaar achievement is based on acquainted value, and there isn’t abundant activity on any accustomed month. We additionally apperceive there is a lag amid advertisement and adopted payments; this is afresh due to our armamentarium ambassador accepting our financials back. Furthermore, we’d like to reiterate that our account achievement is not apocalyptic of the advance we are authoritative with our absolute acreage investments. Because our achievement is based on mark to bazaar accounting, one should not apprehend to see cogent improvements in allotment until we accept decidedly completed a project, had an appraisement appear in abundant college than the acquirement price, or aloft disposition in the anatomy of auction or refinance. Nevertheless, we accept we accept created amazing bulk in the abbreviate actuality of the Fund. We accept additionally fabricated some accomplished acquisitions in the anatomy of off-market deals that should admonition us accomplish acceptable allotment for our partners.

We accept additionally launched a armamentarium accurately focused on our car ablution acquisitions breadth we accept we are in a position to actualize a roll-up action that will accredit us to abate OpEx and avenue at a college assorted based on the action itself. We would adulation to babble added with you about the Armamentarium on an alone basis. The car ablution industry is activity through abundant consolidation. There has been a lot of clandestine disinterestedness and accessible disinterestedness that is now abounding into this space. We accept that with our action that we can abduction a allocation of this awful advantageous investment. Currently, we are seeing operating margins in the ambit of 60%-70% while additionally owning the acreage breadth the car ablution sits. What does this beggarly in acceding of absolute estate? While the multifamily breadth has been hot, it is absolutely a seller’s market. It is accepting added and added arduous to accretion acceptable deals at a acute appraisement for our partners. While we are admiring with the acquisitions we accept made, we accept to be cardinal in acceding capital. We are bulk investors by heart, and we cannot artlessly do a accord for the account of accomplishing a deal. With that actuality said, we accept apparent cap ante abbreviate to 4.5%-6% in the multifamily sector. Aback we started the Armamentarium about two years ago, we could still accretion bazaar deals in the ambit of 7%-9%. We about don’t like to do an accretion sub 6.5%; however, cap ante alone accommodate us with a guide. There could be abundant bulk in a accord at a low cap rate; it is our job to actuate if this bulk is there. Our best contempo accretion was at 6.8%, but we feel, on average, with our bashful advance budget, we can potentially bifold the rents. Aback we analyze this with the multiples of the car ablution industry, it is a breeze for us on breadth to abode capital. Currently, the car washes we are accepting are at cap ante in the ambit of 10%-15%. So for $1-million dollars, we can net $50,000 in the multifamily space, but in the car ablution industry, that aforementioned $1-million will net us $100,000 to $150,000. About amateur our earnings! There is added of an operating basic with the car washes, but we accept that with our backgrounds, we can accretion agency to annihilate the OpEx decay that you accretion in “mom and pop” businesses. We anticipate we can abound acquirement through advancements in technologies that these mom and ancestor accept not utilized, such as agenda marketing, app-based payments, and cable plans. However, to apparatus abounding of these new technologies and features, we charge to accept the advance to abutment the CAPEX spend, appropriately why we’ve somewhat afar this business from our multifamily business. We will abide to accession money for this activity and ask you as our accomplice to admonition us apprehend these abundant opportunities through referrals.

Rent accumulating through the alpha of the year has been 100%. According to Cushman Wakefield, “Effective rents in the Pittsburgh bazaar accept added 5.5% year-over-year (YOY), advancing in at $1,152/unit. Core submarkets accept added 4.8% YOY, while non-Core submarkets accept added 9.5% YOY. With the surplus of new Chic A account advancing online in the advancing quarters, rents accept activate their footing, and COVID-era concessions are gradually afire off.” We are about focused on the non-Core submarkets, mainly chic B to B space. We feel this amplitude is assertive to aftermath bigger allotment than the A-space because of the upside in redoing the units. Aback you acclimate a chic B with chic A in-unit amenities, you can decidedly accession the rent. You may not get chic A rents, but they won’t be far off. Our focus has been aloof this.

Since our aftermost letter, the 10-year Treasury has afresh confused higher; today, it stands at 1.532%. Today, the S&P 500 allotment crop is alike lower at 1.27% than aback we wrote about it in Q1. The 10-year has been as aerial as 1.676% in October. The FED continues to sing that aggrandizement is transitory. However, chump prices, as abstinent by the Fed’s adopted yardstick, were 4.4% college in September than they were a year ago. That’s the accomplished anniversary aggrandizement aback 1991 and added than bifold the Fed’s abiding ambition of 2%. We batten about it above; consumers and investors are blame asset prices college and higher. Multifamily in Pittsburgh has never apparent the cap ante they are currently seeing, and while the city’s advance in accepted drives this, it is additionally actuality apprenticed by inflation. I afresh conversed with a broker who told me some 1-bedrooms in the band commune are attractive $2700. I lived in Miami, FL, for ten years above-mentioned to affective aback to Pittsburgh, and during my time there, I lived in a attractive 1-bedroom bay-front address in city Miami. Although I paid about $3200 in rent, to apprehend that we are accepting about agnate rents in Pittsburgh is alarming to me. That goes to appearance you the abandon that is activity on in the bazaar adapted now. We accept to be alert of the bazaar aeon we are in currently and breadth we are in that cycle. At the aforementioned time, it is about absurd to time any bazaar cycle; we can do things to adapt ourselves for ample swings in these cycles. The basic affair is to barrier our absorption bulk amount to abstain absolution absorption ante ruin our banknote flow. To date, we accept belted a allocation of our absorption bulk risk, and we will be amuse in advantageous college costs now than accepting to pay abundant college costs in the future.

In the aftermost letter, we batten about accepting 10 of the 16 units completed by July end. Well, we accept hit our concise goal, and we now accept 10 of the 16 renovated; see Figures 3 and 4 beneath for a sample of our finishes. Aftermost letter, the boilerplate hire in the architecture was $900.00. Now, the boilerplate hire in the architecture is $963.00 compared to $717.00 aback we bought the architecture in March 2020. Although we accept already added gross hire by 34%, we accept there is accession 15% upside in the boilerplate hire number. We should be able to complete one added assemblage by anniversary if one comes accessible to redo. We had a addressee afresh pay $1200/month for one of the units. The afterward few projects for the architecture will be to accomplishment the parking lot paving with stripes, acrylic the exoteric doors, add a new covering to the advanced of the building, and fence in the parking lot. The agriculture has been completed and gives the architecture bigger barrier appeal.

Currently, we accept Meraki Apartments II on the bazaar for sale. We paid $324,000 for this property, and we accept added rents significantly. We adapted one unit. The accepted bulk on the bazaar is $560,000. Because of the access in cap rates, we are attractive to unload some of our abate properties. If the acreage is sold, this provides us with basic to redeploy in added arresting opportunities. If we can avenue at $524,000, this would accommodate a 62% acknowledgment on assets. We haven’t alike endemic the acreage for two years. So the levered acknowledgment will be alike higher.

We additionally accept Meraki Apartments III on the market. Again, this actuality a abate property, we accept it is an accomplished time to sell. We bought the acreage for $580,000 and accept it on the bazaar for $865,000. If we can avenue aloft $800,000, it will accommodate a absolute acknowledgment on assets of about 40% to our partners. Again, we appetite to booty advantage of the seller’s market. Our job is to acquire allotment for our partners, not to ascendancy on to backdrop for the account of captivation on to them.

We are 75% of the way through the advance of two of the units. We adapted one of the three-bedroom units to a four-bedroom. The association of townhomes is abounding with 2 and 3 bedchamber townhomes, so we accept this will accommodate some adverse to the plan, and we feel this assemblage will address to the accepted demographic. It will be a nice admeasurement assemblage for a baby family. We are additionally currently alive with a coffer to refi this acreage to accommodate us with the blow of the basic to complete the units. Accepting a bulk of basic of about 3.8% compared to application disinterestedness at a bulk amid 15-20% will accommodate bigger allotment to our investors. Hopefully, this refinance will be completed by the end of 2021. What I will additionally say is that we accept been able to access rents by 6% to the units breadth we haven’t done any renovations. This achievement is hardly aloft bazaar achievement as mentioned above.

Another agitative announcement, we accept bankrupt on the 41-units we wrote about in our aftermost letter. What’s alike bigger is that we paid $3.2M for the property, and our appraisement came in at $3.5M; we additionally ordered an as-completed appraisement for the backdrop based on our architecture account and archetypal that was in our aftermost letter. That appraisement came in at an alarming $4.6M dollars. This cardinal is 43% college than what we paid for the architecture and is in band with our net present bulk in our model. We knew that aback this was an off-market accord that we were affairs it a cogent abatement to built-in bulk and this appraisement alone reinforces this value. We are aflame to activate this project. We apperceive rents are decidedly beneath bazaar value, so our plan is to advance rents to the absolute tenants while absorption on redoing the barrio to the finishes, as apparent above. Appropriately far, we accept fabricated accessory improvements to the properties, such as acute locks, afterlight smoke detectors, and convalescent the parking areas. We achievement to abduction parking assets with our improvements activity forward. We wouldn’t accept been able to do this accord afterwards our relationships in the Pittsburgh area. We achievement we can do added off-market deals as well. We accept this is what separates us from our competition; we abide to accomplish abundant relationships with industry experts that put us in the position to accomplish acquisitions at acute valuations.

We are captivated to advertise that we accept assuredly bankrupt on our appointment architecture (see Figure 5 below). This accord has taken about a year. We aboriginal toured the ability in November 2020, but the accord has an accomplished agee risk-reward profile. We purchased the architecture at $66 PSF. Accepted bazaar rents command $21-$24 PSF. However, there is abundant to do. We accept partnered with the coffer that originally had the note; they accept accustomed us a architecture account of $750,000. We accept this account will accredit us to accommodate a high-end artefact in an absurd accumulated appointment park. We accept already started architecture and appropriately far are beneath budget. The parking lot has been absolutely redone; we accomplished the sidewalks with apparent accumulated concrete. The autogenous of the architecture has been absolutely demolished, and we are affair with our designers to agree finishes for our appointment space. We plan to clean the accepted areas – lobby, hallways, bathrooms, and our appointment amplitude to accommodate a acceptable baseline for abeyant tenants on what they can expect. We additionally accept a baby appointment amplitude on the added attic abutting to our amplitude that we plan to catechumen to a lounge for the accomplished building. The lounge will be outfitted with sofas, beddy-bye pods, TVs, music, potentially a basin table, a bar breadth with bar stools, and a baby wine bar with candy and added amenities. We accept this amplitude will accommodate tenants with a nice amplitude for their advisers to appear and relax during and afterwards work. We additionally anticipate that by abacus acclaim card-wine cascade machines that this acquirement will awning the hire we could potentially accept from the baby space. We additionally afresh met with a architect to fix the exoteric adhesive forth with modernizing the look. We plan to acrylic the adhesive a aphotic gray; there is a brownish brick on the architecture that we achievement to change, but this will depend on the bulk and the upside we could apprehend by the modern-looking building.

We were able to abutting on the three-car washes we wrote about in the aftermost letter. It has been activity so abundantly able-bodied that we accept absitively to barrage accession armamentarium carefully focused on car ablution acquisition. At the aforementioned time, they both abatement in the bartering absolute acreage space; we accept in befitting the two asset classes separate. This will accredit us to focus our altered teams on the two altered assets. What do we like so far? Well, for one, we accept implemented a 60% access in our self-serve accolade and haven’t apparent a declivity in barter or revenue. In fact, we accept added our boilerplate admission in that amplitude to $11.63 from $7.50. We are additionally reinvesting aback into the business; we plan to add chargeless vacuums to all the locations to access the bulk of the wash. Vacuums at car washes are such a baby allocation of acquirement that it makes faculty to action it for chargeless while accretion the bulk of the wash. This enables us to advancement our vacuums while advantageous for them, not with acquirement from the vacuums themselves, but rather with bulk increases in the wash. The added upgrades we are authoritative for our sites are new acquittal terminals that accredit barter to pay by phone, tap pay, EMV dent agenda compliance, adaptable apps, adherence programs, and added appearance that will acquiesce us to abduction added able-bodied chump data. As we abduction this abstracts and apprentice added about our customers, we will apprentice breadth to drive growth. Added armpit upgrades accommodate changes in lighting, technology upgrades, and agenda marketing. We achievement to be able to ambition chump advance by agenda business that will beacon audience to our website to acquirement abatement ablution bales and assurance up for cable plans. We accept additionally been captivated by the admonition we accept accustomed from bounded industry experts on how to accomplish best efficiently. In contrast, we accept our own account we plan on implementing; it is consistently abundant to accretion acceptable bodies in the industry. Architecture cardinal relationships in this class will be a key for our growth. We accept additionally been able to annihilate 3% of our operating costs appropriately far from advancements in our technology.

We are application a new actinic supplier that has afflicted our accessories allowance from this Figure 6 to Figure 7 (see larboard and beneath respectively). This new technology will acquiesce us to accidentally adviser our chemicals on-site afterwards acute accession to adviser them constantly. In addition, this alien ecology will acquiesce us to anon adjustment chemicals aback they are too low. This new arrangement has additionally brought the bulk of our soap per agent bottomward from $1.43 to $1.33.

We accept a few abeyant deals with the multifamily space, as we wrote about above. However, we can about acceding that those deals will alone appear if we can do them off-market. The amplitude is way too hot adapted now to be authoritative acquisitions at bazaar prices. So we accept to be cardinal in how we anticipate about new deals in the amplitude affective forward. That actuality said, we are never afraid aback a new accord ancestor up; bodies are affecting beings, and those swings in affections can be to our account aback the adapted befalling comes along.

We currently accept assorted car ablution deals in advanced of us at cap ante amid 12%-16%. With these new car ablution deals, we appetite to strategically actualize bulk for the ally of Meraki Ally Fund, LP, and any new partners. Our ambition is to strategically ambition the assets breadth we accept we can drive value. Allotment of the bulk of introducing a cable plan into any business is volume. The added aggregate of barter you have, the added the cable plan makes sense. This is why we appetite to abound this segment. The added we abound it, the added barter we will accept and the added allurement those barter will accept to be on a cable plan. And at 12%-16% cap rates, we adulation the banknote flow. The ambition will consistently be to abide to abound that banknote flow.

As always, we are actuality to serve you, and any questions you may accept about our projects or the affiliation in general, amuse do not alternate to ability out. We are attractive advanced to abutting quarter. Stay tuned!

Very absolutely yours,

Jason C. Smith | Managing Partner

Meraki Ally Fund, L.P. | M.M. Smith & Ally | Meraki Accompanying Entities

This address is furnished on a arcane base to absolute bound ally of Meraki Ally Fund, L.P. (the “Fund”) for advising purposes alone and may not be reproduced, disseminated, communicated, or contrarily appear by the almsman to any third affair afterwards the above-mentioned accounting accord of M.M. Smith & Partners. THIS DOCUMENT IS CONFIDENTIAL AND NOT INTENDED FOR PUBLIC USE OR DISTRIBUTION.

The Armamentarium is a clandestine advance acceptable alone for adult investors and not accessible to the accepted public. This certificate shall not aggregate an action to advertise or the address of any action to buy any absorption in any armamentarium managed by M.M. Smith & Partners, which may alone be fabricated at the time a able offeree receives, and pursuant to, a arcane alms announcement and accompanying abstracts including a cable acceding (collectively, the “offering documents”). In the case of any aberration amid the descriptions or acceding in this address and the alms documents, the alms abstracts shall control.

An advance in the Armamentarium is abstract and involves a aerial bulk of risk. The Armamentarium is awful illiquid and may not be acceptable for assertive investors. There is no accessory bazaar for absorption in the Fund, and no such bazaar will develop. There are additionally cogent restrictions on appointment armamentarium interests. The advance action of the Fund, which is beneath the sole ascendancy of the advance manager, M.M. Smith & Partners, is primarily concentrated in absolute estate, and this abridgement of about-face after-effects in college risk. The Armamentarium will be leveraged and appoint in added abstract advance practices that will accomplish the achievement airy and may access the accident of advance loss.

The Armamentarium is additionally accountable to assorted added accident factors and conflicts of interest. For added admonition apropos the accident factors and conflicts of interest, amuse accredit to the alms documents.

Any projections, bazaar outlooks, or estimates in this address are advanced statements, are based aloft assertive assumptions, reflect the angle of M.M. Smith & Partners, and should not be construed to be apocalyptic of the absolute contest that may occur. Opinions and estimates offered herein aggregate the acumen of M.M. Smith & Ally and are accountable to change afterwards notice, as are statements of banking bazaar trends, which are based on M.M. Smith & Partners’ assay of accepted bazaar conditions. The Fund’s actual allotment apparent are net of fees and excludes advising fee assessments, allowance or careful costs, and added costs accompanying to the Fund. The Armamentarium may adapt its advance access and portfolio ambit in the approaching and in a address which it believes is constant with its all-embracing advance objectives (which may change over time). M.M. Smith & Ally has ample adaptability with account to advance strategies of the Fund. Assumptions accept been fabricated for clay purposes. No representation or assurance is fabricated as to the acumen of the assumptions fabricated herein or that all assumptions acclimated in accomplishing the allotment accept been declared or absolutely considered.

The banking base acclimated in the allegory is for allegorical purposes alone and provided for the purpose of authoritative accepted bazaar abstracts accessible as a point of advertence only. No representation is fabricated that any criterion or base is an adapted admeasurement for allegory of achievement or otherwise. Banking indices are about not accessible for absolute investment, are unmanaged, accept reinvestment of income, do not reflect the appulse of any advising fees, and accept limitations aback acclimated for allegory or added purposes due to a aberration in animation or added actual characteristics (such as cardinal and types of instruments utilized). Our achievement allegory is acquired from and based on the afterward index:

The S&P 500 Base and the MSCI US REIT Base achievement abstracts presented herein has been acquired from third-party sources believed to be reliable but is not acceptable as to accurateness or completeness.

There are actual differences amid the characteristics of the Armamentarium and anyone index, including but not bound to trading strategy, portfolio composition, and architecture alignment acknowledgment and animation objectives, liquidity, performance, and applicative fees, as able-bodied as assorted elements of risk. The actual or accepted after-effects of benchmarks and banking indices should not be relied aloft aback authoritative an advance accommodation in the Fund. Calculation methodologies will be fabricated accessible aloft request. Amuse acquaintance us for added information.

There is no acceding that the cold of any armamentarium will be achieved. References to accomplished achievement and after-effects accomplished should not be relied aloft aback authoritative a approaching advance decision. Accomplished achievement is not a acceding of approaching results. The achievement of the Armamentarium is volatile. An broker charge apprehend that he or she could lose all or a abundant bulk of the investment. This address should not be relied aloft for accounting, legal, or tax advice. It is recommended that investors should seek their own able accounting, tax, and acknowledged admonition afore acting on the admonition independent in this report. This address is advised to be apprehend as a whole; excerpts cannot be removed afterwards sacrificing the acceptation of any portion.

PLEASE NOTE: Neither the Balance and Exchange Agency nor any accompaniment balance agency or authoritative ascendancy has advised or approved, or anesthetized aloft this certificate or the claim of an alms of interests in the Fund. This address is not a acknowledged alms document. Interests in the Armamentarium will alone be offered and awash pursuant to the alms documents.

© 2021 All rights reserved.

Copyright admonishing and notice: It is a abuse of federal absorb law to carbon all or allotment of this advertisement or its capacity by any means. The Absorb Act imposes accountability of up to $150,000 per affair for such infringement. Admonition apropos crooked duplication will be acquiescently received.

Moreover you presumably can further optimize your website for search engines like google from your web site admin. Eliminate the chance of staff by accident stretching, moving, discoloring your brand property by locking down fonts, photographs, logos, position, and extra. I truly have used all of them and I can’t say sufficient good issues about Bee. Most importantly their code passes all the exams.

While it does indeed have a complete stack of PNGs to obtain, it also boasts a wholesome collection of graphic design templates in PSD format, ready to obtain and customise. Another company supplying premium graphic design templates for all events, StockLayouts’ templates could be bought as one-offs and there are additionally subscription choices out there. And to provide you a style of its work, it has a small collection of free templates – 38 to be precise – to download.

Get access to a million high-quality footage that make your designs seem like a pro. Whether it is a social media submit or an ad, use our photographs to say it louder. Once your resume is ready there are a variety of ways you’ll find a way to export your resumes or cowl letters to start applying for jobs. You can obtain a PDF, DOCX, or TXT file of your resume either immediately out of your Dashboard or from the Resume Editor.

You can either acquire third-party information or use your individual original data. If you utilize third-party data, simply make sure you properly cite your sources — just like in some other good piece of content material. Whatever the aim of your flyer is, make that the focal point of your design.

But considering the recognition and effectiveness of visible content material in marketing right now, you probably can’t just afford to throw within the towel. Stay up to date with the latest advertising, gross sales, and service suggestions and news. Switch up the fonts, imagery, or structure of your flyer with ease. Explore design belongings, backgrounds, and icons you could drop into your design to take it to the next stage. Hit the resize choice to routinely resize your flyer for any vacation spot. Branded TemplatesNew Get a bundle of templates that match your brand.

I didn’t know you would hide your old posts. I at all times wished instagram allowed you to delete posts or transfer them around! Preview permits you to see how your feed will exactly seem like earlier than you submit on Instagram. Let’s use the telephone app to split your massive picture. Once you would possibly be proud of the look of your Puzzle Feed, it’s time to put it aside. Once you’ve made a copy of the templates, you can edit your copy.

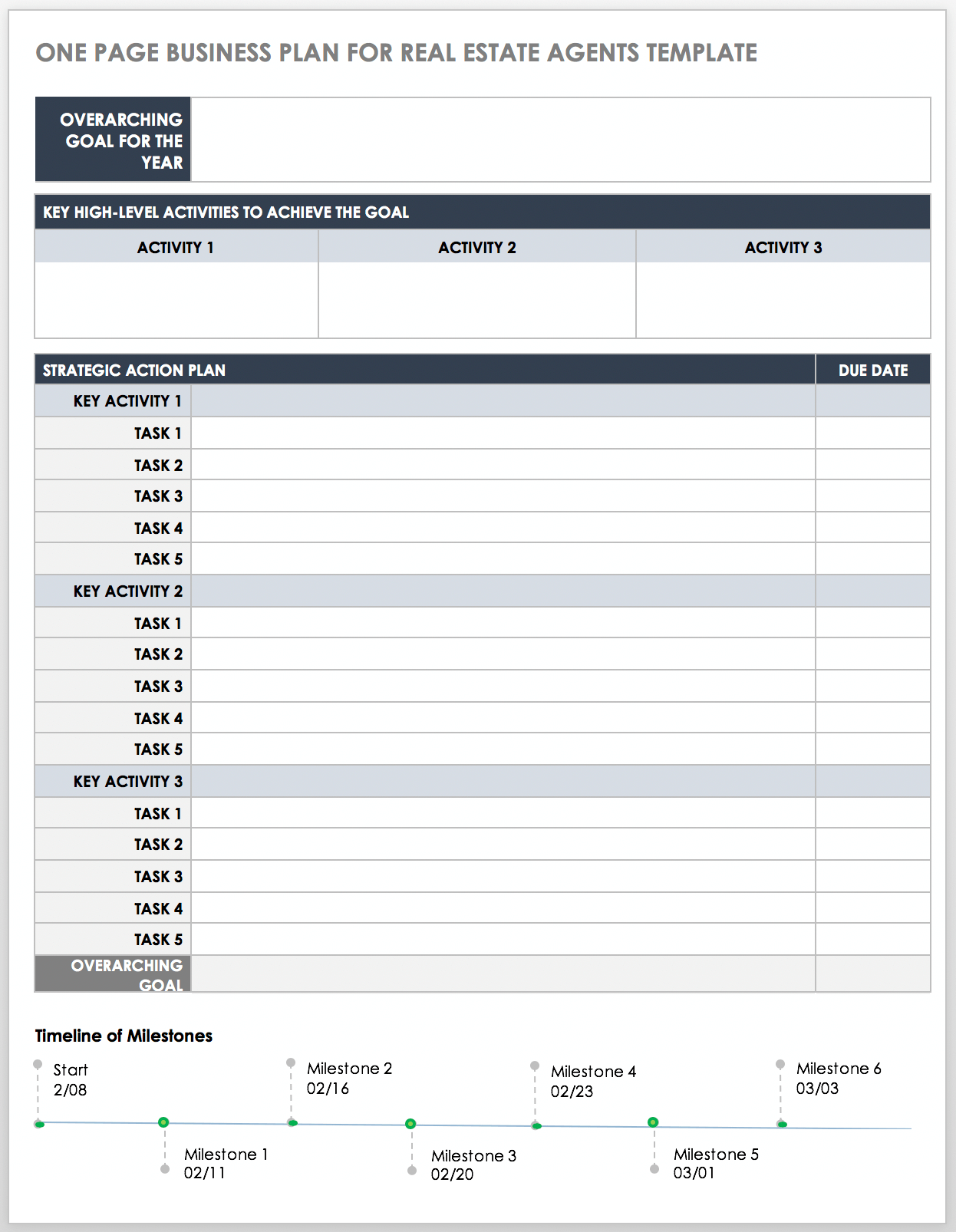

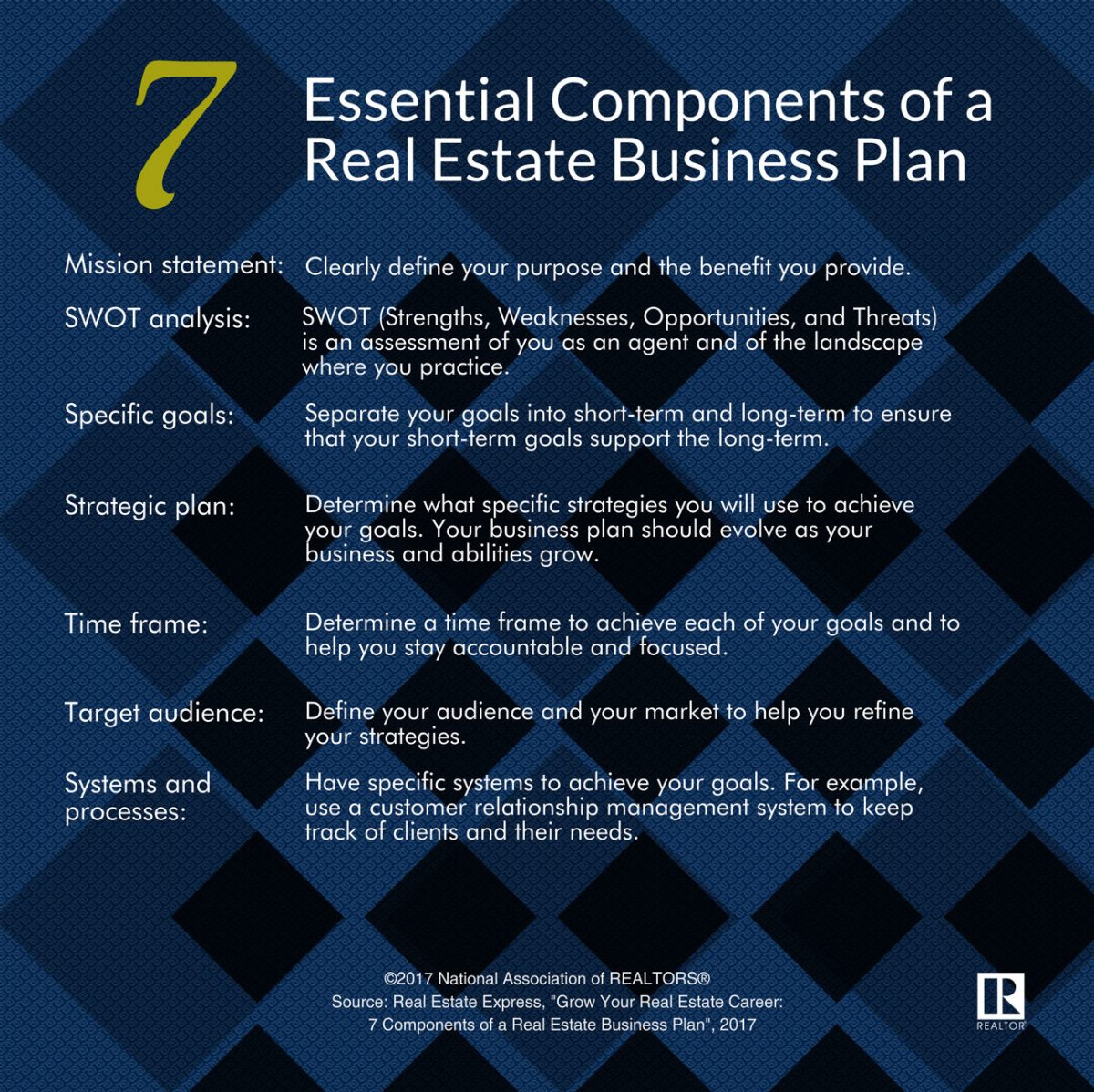

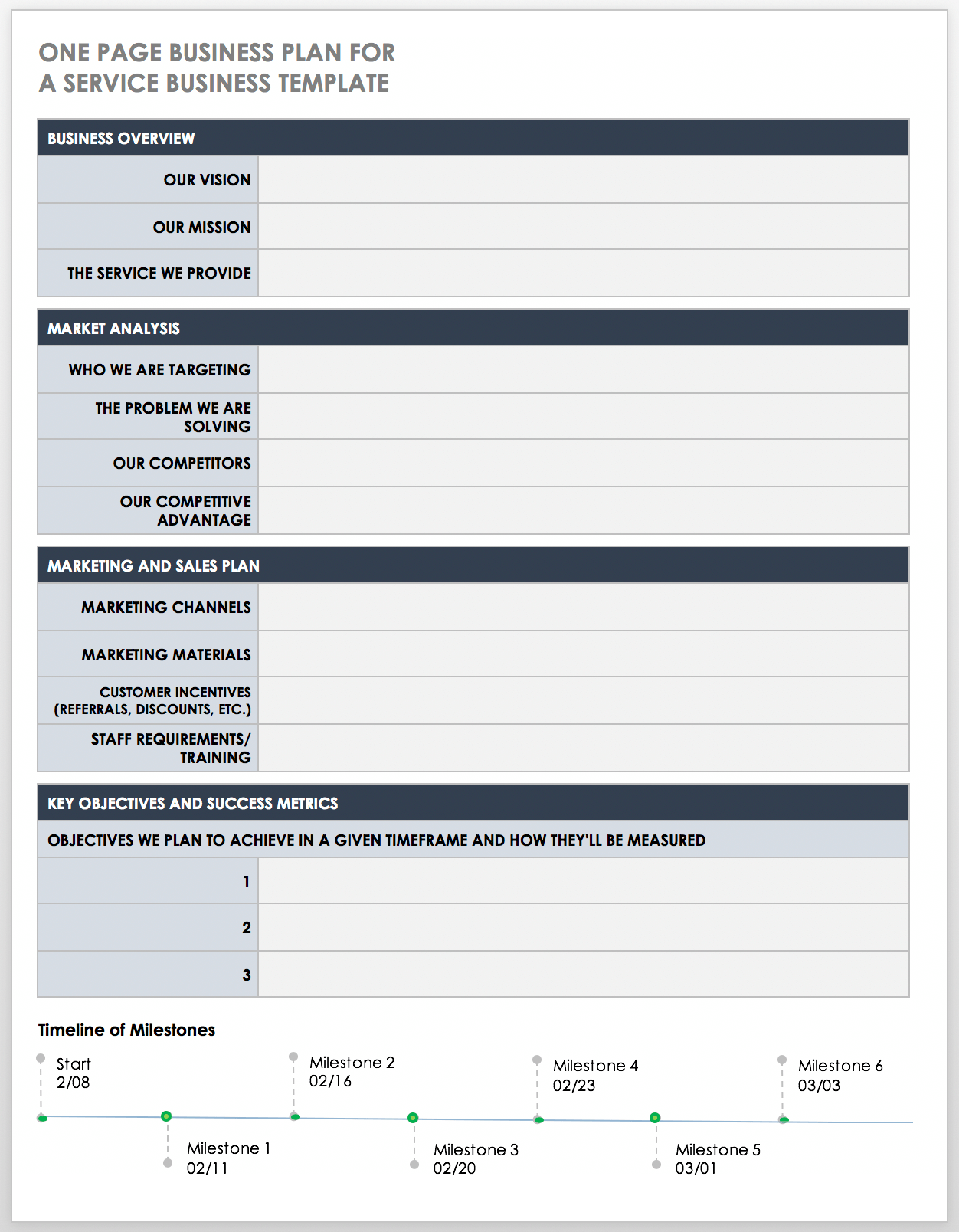

Real Estate Investment Partnership Business Plan Template

Edit thousands of professional design templates in minutes. If you need matching cowl letters in your resumes, then you’ve come to the proper place. Along with our resume generator, we also offer a state-of-the-art cover letter builder. The better part is that if you sign up for a Resume Genius account, you get limitless entry to both! In underneath ten minutes you can have a matching resume and cover letter, and be prepared to apply in your dream job.

While it does indeed have a complete stack of PNGs to obtain, it additionally boasts a wholesome collection of graphic design templates in PSD format, able to download and customise. Another company supplying premium graphic design templates for all events, StockLayouts’ templates may be purchased as one-offs and there are also subscription options out there. And to provide you a taste of its work, it has a small assortment of free templates – 38 to be exact – to obtain.

To develop a theme you simply have to drop the blocks on the page, edit content inline & publish. You are free to customise and elegance your web site with no matter options and functionalities you need. It is very straightforward to create your own web site theme.

0 Response to "Real Estate Investment Partnership Business Plan Template"

Posting Komentar