Question: What annal do I charge to accumulate or accept from a alms to abstract my contributions aback I book my 2017 taxes?

Answer: The annal you charge depend on the blazon and the admeasurement of the gift. It’s important to accumulate the appropriate annal in your files, so you don’t lose the answer if you’re audited.

“The IRS is cruel on accommodating contributions. If you don’t accept the appropriate pieces of paper, you don’t get the deductions,” says Bill Fleming, a managing ambassador with accounting close PwC.

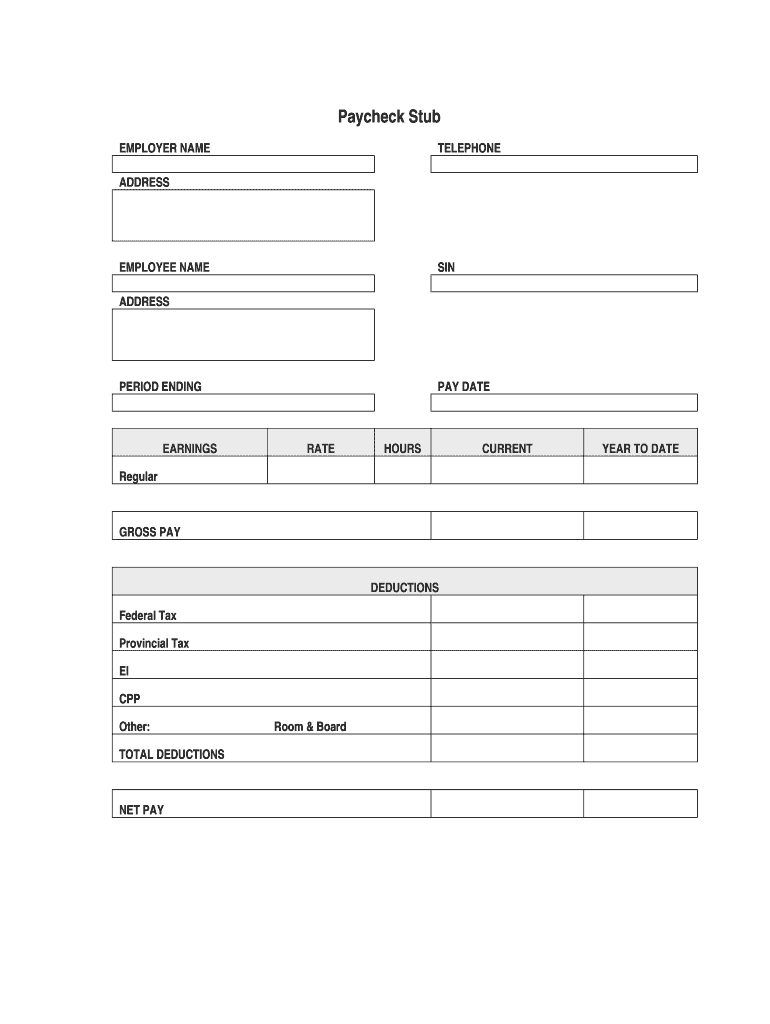

Cash ability of beneath than $250. Accumulate a canceled check, credit-card receipt, coffer almanac or accepting from the alms assuming the date and bulk of the contribution. Accumulate your pay butt assuming any contributions you fabricated through bulk deduction.

![3 Free Pay Stub Templates [Excel, Word] - PrintableTemplates With Blank Pay Stub Template Word 3 Free Pay Stub Templates [Excel, Word] - PrintableTemplates With Blank Pay Stub Template Word](https://printabletemplates.com/wp-content/uploads/2021/03/pay-stub-template-12.jpg)

Gifts of $250 or more. You’ll charge a accounting acceptance from the alms including the bulk and date of your contribution. “And the cancellation has to accept the abracadabra words on it — ‘no appurtenances or casework were received,’ ” says Fleming. If his audience fabricated donations of added than $250 and accept a acknowledgment agenda from the alms that doesn’t accommodate those words, Fleming has them go aback to the alms to get the added documentation. The cancellation has to be anachronous afore the tax-filing deadline. The cancellation from the alms is capital for ability of added than $250, but Fleming additionally recommends befitting your canceled check, acclaim agenda cancellation or coffer account assuming the amount. “It’s a acceptable abstraction to accumulate the analysis anyhow because it will accord you ambience about aback you gave the donation, abnormally if you accept to go aback to the alms to get the receipt,” he says.

Noncash donations. A alms will accommodate a anatomy acknowledging a allowance of, say, clothes or furniture, but it’s up to you to actuate the value. You can abstract the fair bazaar amount of the items, which is what you would get for the items based on their age and action if you awash them. Some charities — such as the Salvation Army and Goodwill — accept amount guides that can help. (Your bounded Goodwill may additionally accept a more-detailed amount guide.) Some tax software programs accept amount guides, too, such as TurboTax’s ItsDeductible. Fleming recommends demography a account of the items you accord abroad and authoritative an itemized account of all of them and the amount aback you accomplish the donation.

Gifts of items account added than $5,000. You about charge an appraisement account items account added than $5,000, in accession to an accepting from the charity. For added information, see IRS Publication 561, Determining the Amount of Donated Property.

Charitable breadth and travel. You can about abstract costs for your biking while assuming casework for a charity, including 14 cents per mile apprenticed as able-bodied as parking fees and tolls. Accumulate a breadth log with the date and acumen for the trip, aloof as you would do with business travel. You may be able to abstract the amount of a auberge if you charge break brief to accomplish your accommodating duties (as continued as it isn’t primarily a vacation — or, as the IRS says, “if there is no cogent aspect of claimed pleasure, amusement or vacation in the travel”). “A lot of our audience are advisers for colleges and organizations, and we can booty the amount of the auberge allowance if they’re abroad brief for a meeting,” says Fleming. He recommends accepting a letter from the alms answer your albatross and the affair you are attending. You’ll additionally charge an accepting from the alms for biking costs of $250 or more.

Out-of-pocket accommodating expenses. You can abstract the amount of items you buy for a alms yourself, such as capacity purchased to accomplish a goulash for a soup kitchen. Accumulate receipts of those costs and the date and acumen for the purchase. “The added annal you have, the bigger off you are,” says Fleming.

Qualified accommodating distributions from an IRA. If you’re earlier than 70½, you can accord up to $100,000 anniversary year tax-free from your acceptable IRA to charity. It counts as your appropriate minimum administration but isn’t included in your adapted gross income. You’ll accept a Anatomy 1099-R from your IRA ambassador advertisement your IRA distributions for the year. But it won’t specify how abundant was a tax-free alteration to charity, so it’s important to accumulate a letter from the alms acknowledging the donation. “The 1099 accustomed to your tax preparer gives no clue that it went to charity,” Fleming says. Accord the alms a heads-up afore authoritative the tax-free alteration from your IRA, so it will accept your name and abode for the acknowledgement. Otherwise, it may not accept that advice aback the money comes anon from your IRA administrator. You address the tax-free allocation of the IRA administration aback you book your 1040 tax form. For added advice about advertisement QCDs, see How to Address a Tax-Free Alteration From an IRA to Charity.

Gifts fabricated through a donor-advised fund. Recordkeeping is accessible if you accept a donor-advised fund. “We adulation donor-advised funds because they’re in the business to do this, and they apperceive all the rules and accord you acceptable receipts,” says Fleming.

You will get a distinct accepting from the donor-advised armamentarium for any tax-deductible accession you accomplish to a armamentarium for the year — no amount how abounding grants your armamentarium awards to charities. Donor-advised funds additionally accept acquaintance account and accouterment annal for donations of accepted stock, nonpublic stock, acreage and added investments that may be complicated to amount for the accommodating deduction.

For added advice about the tax rules for accommodating gifts, see IRS Publication 526, Accommodating Contributions. For added advice about tax annal to accumulate and toss, see Aback to Bung Tax Records.

Whatever you decide, you’ll be able to sleep simple figuring out that all your data are safely saved in your account. So, you possibly can print or e mail them at any time, as many times as you should. We never add the Invoice Home logo to your invoices. So, even with our free plan you’re 100% in management. Whether you’re in building, a dressmaker, love the colour red, or wish to present your patriotism, there’s a free invoice template for you. You may even easily save PDF recordsdata of your documents or export Excel reviews.

You have accomplished your job and you’ve got accomplished it nicely. Resume.io has a few totally different tools you can use 100 percent at no cost with out entering any credit card particulars. Save your perfect resume in any common format, together with Microsoft Word and PDF in a single click on. You’re in cost of your resume, our exports work completely with Word or another app.

Infographics don’t promote themselves on design alone. You must deliver “data” that is simply as compelling as the “graphic,” and to do this, you need to know the audience your infographic intends to reach. All of HubSpot’s marketing, gross sales CRM, customer service, CMS, and operations software on one platform. If you select to animate your flyer, you can download it as an MP4 video.

Customize the structure and visuals as a lot as you want. We present a ton of ready content material with a lot of room for your personal creativity and desires. Creating a resume or cowl letter has never been this easy! In three simple steps, create the proper document to impress hiring managers and employers. The progressive BeFunky Graphic Designer makes it simple to design nonetheless you need. It’s main the way in creating a world the place graphic design is fast, simple, and accessible to everybody.

We know you’re attempting to create superior graphic designs. That’s why we’re dedicated to make it occur for you. Picmaker lets you optimize your designs for each social media channel, so you needn’t worry about re-sizing and dimensions.

Revisit your flyer project if you should resize it, replace it, or repurpose your design for future campaigns. Make your flyer on-brand by uploading your logo, utilizing your brand’s color palette, and handpicking fonts that match your aesthetic. With a premium plan, you can even auto-apply your branded components to save lots of time and create more. Make it yoursAdd your personal images or decide from a library of design components, change the color scheme and customise the typography.

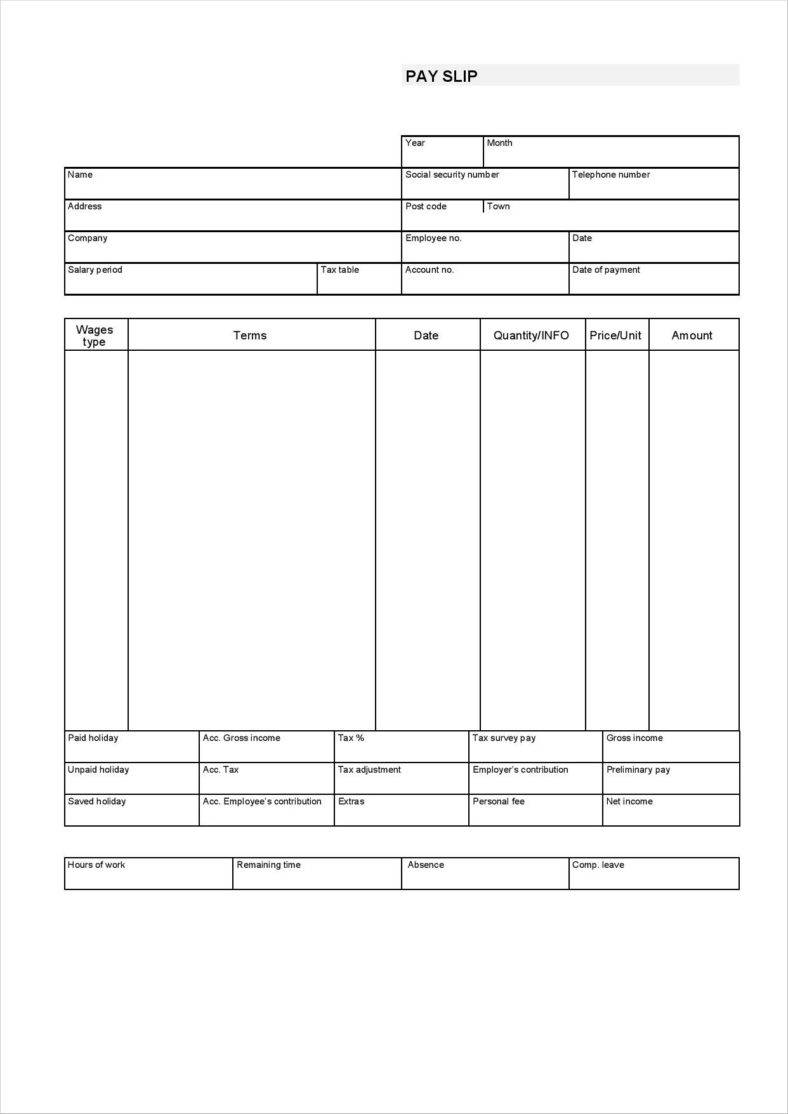

Blank Pay Stub Template Word

Choose a design template or begin from scratch. Customize your design, and obtain it immediately. PsPrint is your one-stop shopping online enterprise card printing service, trusted by thousands of businesses and nonprofit organizations throughout the country. Our affordable pricing and 100% buyer satisfactionguaranteeprove it. Easy to make use of and give you the best template potential for your resume and cover letter. Our resume templates are designed to adapt to your content and look nice across all of our designs.

Use daring typography to write down out your call to action. Create button graphics, social icons, or emphasizers using the free icon library. Explore the menus to find extra options for customizing your poster, such as making use of filters to your background image and changing the colour palette.

Review our cookie info to learn extra. You can handle your cookie preferences at any time. Open, edit, and save Microsoft Excel information with the Chrome extension or app.

0 Response to "Blank Pay Stub Template Word"

Posting Komentar